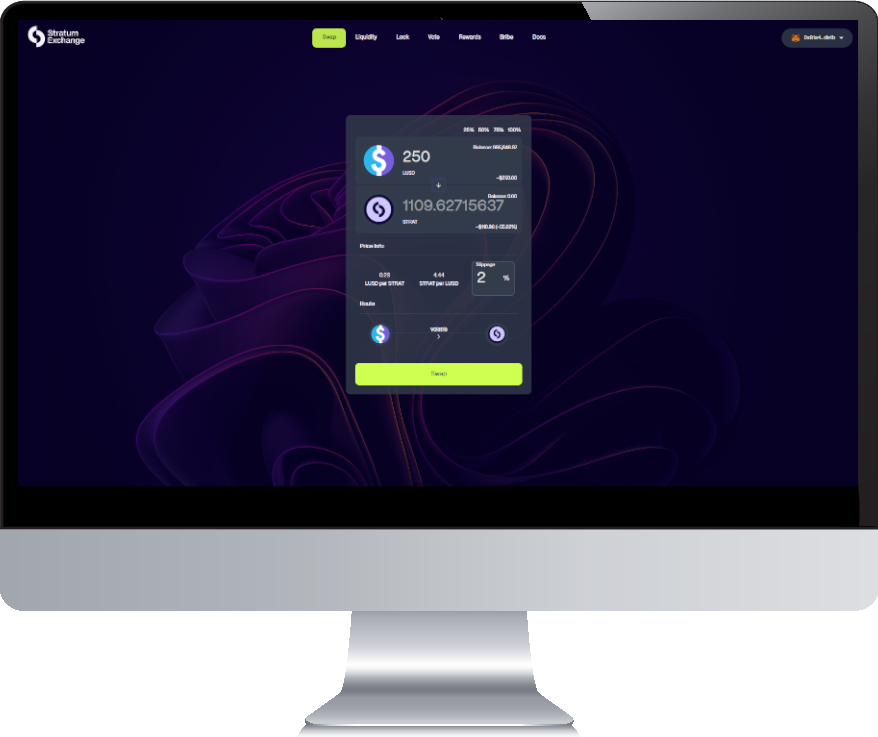

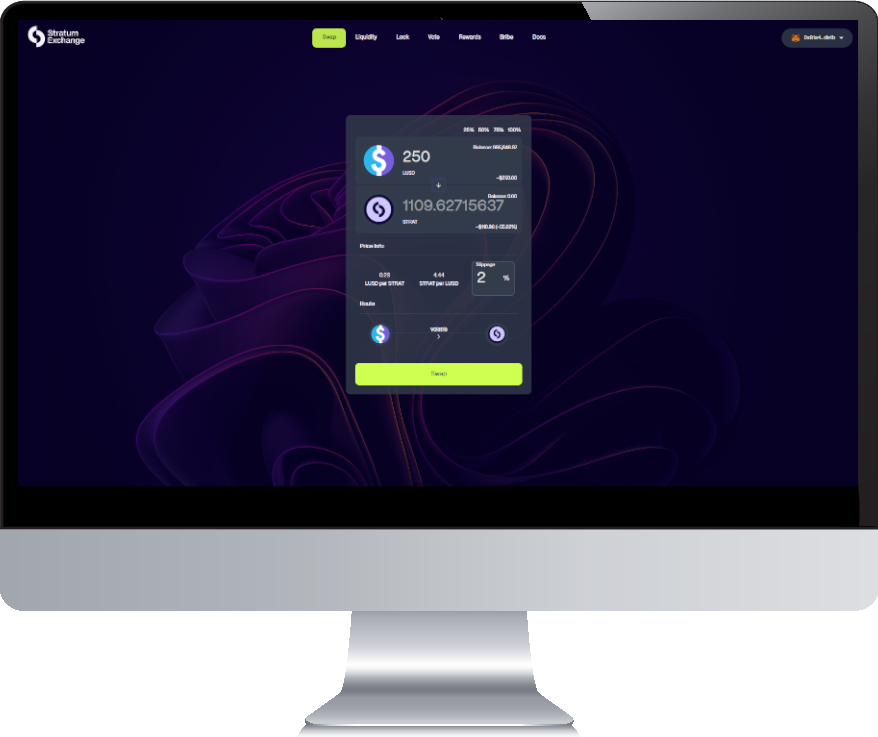

Swapping

Swap your tokens with low slippage.

Stratum houses deep liquidity, low fees, and near 0 slippage when swapping correlated assets.

Earn staking rewards

Stake your LP tokens into gauges to earn rewards in STRAT. No deposit or withdrawal fees or lock-ups. You have full control over your funds.

Liquidity Layer for Mantle

Stratum was designed by combining the most successful DEX techniques into a new, innovative flywheel. Protocols can bribe veSTRAT holders or acquire veSTRAT to redirect emissions to their pools, offering a flexible and capital-efficient solution to bootstrap and scale liquidity.

How it works for veSTRAT Holders

Lock STRAT Token and Receive veSTRAT

Lock STRAT for up to 52 weeks. The longer, the more veSTRAT.

Vote for Your Favorite Pools

veSTRAT gives power to decide pool emissions.

Receive Bribes and Trading Fees

Vote and claim a share of Bribes and Fees.

Novel ve(3,3) Tokenomics

Inspired by Andre Cronje's Solidly, STRAT takes a novel approach to the voting-escrow model. Stratum has an exponential decay programmed within the core, ensuring a sustainable token model for years to come. The STRAT model rewards long-term supporters, and aligns stakeholders interests by incentivizing fee generation.

Low Fee Hybrid vAMM / sAMM

The trading fees for volatile pools is 0.3%, and for stables pools it is 0.04%. These can be adjusted for up to 0.5% and 0.1% respectively by Stratum DAO voting. The low fees and depth of liquidity aim to drive volume, which in turn sends value back to veSTRAT voters in the form of their share of protocol trading fees.

How it works for Protocols

Request Gauge Whitelisting

Protocols need initial approval to open a gauge for voting.

Create a Bribe with few Clicks

Bribe a gauge easily once initiated. Bribes are set per 7-day epoch.

Receive Emissions from veSTRAT Holder Votes

Emissions are based on votes from veSTRAT holders for the new epoch.

Launch App

Launch App Check Rewards

Check Rewards Claim Vesting STRAT

Claim Vesting STRAT